- Introduction

- Function Introduction

- Performance Monitor

- Fusion Hunter

- Quantitative Chart

- SEC Filing

- Insider Trading (Search by Ticker)

- Insider Trading (Search by Reporter)

- Insider Trading (Top Insider Trading)

- Institutional Holdings

- Investment Trends (Investment Company List)

- Investment Trends (Sector & Industry Sentiment)

- Investment Trends (Investment Company Sentiment)

- Investment Trends (Top Institutional Trading)

- Investment Trends (Top Institutional Hldg Change)

- Key Ratio Distribution

- Screener

- Financial Statement

- Key Metrics

- High Current Difference

- Low Current Difference

- Relative Strength Index

- KDJ

- Bollinger Bands

- Price Earnings Ratio

- Price to Book Value

- Debt Equity Ratio

- Leverage Ratio

- Return on Equity

- Return on Assets

- Gross Margin

- Net Profit Margin

- Operating Margin

- Income Growth

- Sales Growth

- Quick Ratio

- Current Ratio

- Interest Coverage

- Institutional Ownership

- Sector & Industry Classification

- Data Portal

- API

- SEC Forms

- Form 4

- Form 3

- Form 5

- CT ORDER

- Form 13F

- Form SC 13D

- Form SC 14D9

- Form SC 13G

- Form SC 13E1

- Form SC 13E3

- Form SC TO

- Form S-3D

- Form S-1

- Form F-1

- Form 8-k

- Form 1-E

- Form 144

- Form 20-F

- Form ARS

- Form 6-K

- Form 10-K

- Form 10-Q

- Form 10-KT

- Form 10-QT

- Form 11-K

- Form DEF 14A

- Form 10-D

- Form 13H

- Form 24F-2

- Form 15

- Form 25

- Form 40-F

- Form 424

- Form 425

- Form 8-A

- Form 8-M

- Form ADV-E

- Form ANNLRPT

- Form APP WD

- Form AW

- Form CB

- Form CORRESP

- Form DSTRBRPT

- Form EFFECT

- Form F-10

- Form F-3

- Form F-4

- Form F-6

- Form F-7

- Form F-9

- Form F-n

- Form X-17A-5

- Form F-X

- Form FWP

- Form G-405

- Form G-FIN

- Form MSD

- Form N-14

- Form N-18F1

- Form N-18F1

- Form N-30B-2

- Form N-54A

- Form N-8A

- Form N-CSR

- Form N-MFP

- Form N-PX

- Form N-Q

- Form TTW

- Form TA-1

- Form T-3

- Form SC 14F1

- Form SE

- Form SP 15D2

- Form SUPPL

- Form 10-12G

- Form 18-K

- Form SD

- Form STOP ORDER

- Form TH

- Form 1

- Form 19B-4(e)

- Form 40-APP

- Form 497

- Form ABS-15G

- Form DRS

- Form MA

- Form UNDER

- AI sentiment

- Access guide

- Academy

- Term of service

- GDPR compliance

- Contact Us

- Question Center

| Font Size: |

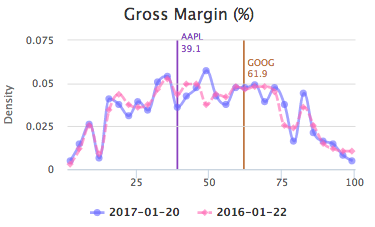

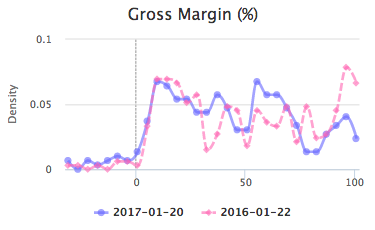

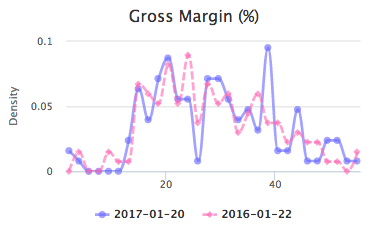

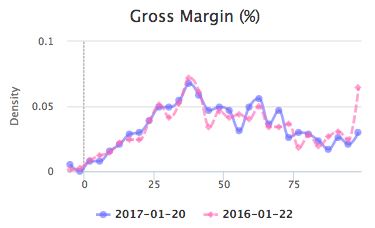

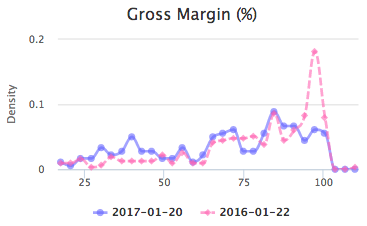

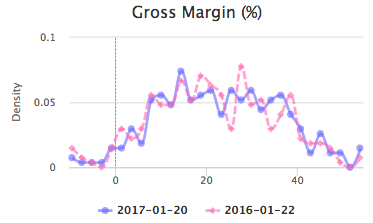

Gross Margin

Gross margin measures the profitability of a business in terms of the percentage of revenue that can be retained after deducting direct costs used to produce goods and services (i.e. operating cost). In Katelynn's Report, gross margin is calculated as Trailing 12 months Gross Profit/Total Revenue * 100%. Higher gross margin represents better performance (higher quantile ranking).

Gross margin varies widely between sectors and industries. So it generally does not make sense to compare gross margins of companies from different sectors or industries. To illustrate this point, the figures below show the distributions of gross margin in technology, energy, consumer durables, consumer services, finance, and basic industries sectors, respectively. The solid blue lines and dashed pink lines are for 2017-01-20 and 2016-01-22, respectively.

Technology |

Energy |

Consumer durables |

Consumer services |

Finance |

Basic industries |

According to the figures shown above, consumer durables and basic industries have the lowest gross margin, while technology and finance have the highest. The observations are generally consistent with our common sense. It is understandable that consumer durables and basic industries require more raw materials and labors to operate than other sectors listed here.

Note that the calculation of gross margin highly depends on how a company defines its operating cost and operating expense, which may change over time, and sometimes have no consistent definition from companies within the same industry. The main difference between operating cost and operating expense is that the former is the expenditure directly associated with the production of goods or services, while the latter is recurring expenditure for maintain the basic function of a business (e.g. administration expense, rent cost, office supplies, compensation for non-production employees).